Auto Insurance Coverage in Las Vegas Nevada

Liability Insurance Requirements in Las Vegas

Car insurance is actually a compulsory requirement for every motorist in Las Vegas, Nevada. The state rule requires every vehicle proprietor to possess a valid insurance policy that covers bodily injury and property damage liability in the event of an accident. Liability insurance assists defend the vehicle driver, their guests, and any sort of other person or even vehicle involved in the accident. Opting for the right insurance coverage for your vehicle is actually a vital selection, as it ensures financial protection in the event that of unpredicted events while driving. Failure to abide by the insurance requirement can easily result in charges, fines, or also suspension of driving privileges.

When buying car insurance in Las Vegas, vehicle drivers possess the option to select in between minimal liability coverage or added comprehensive coverage. Minimum liability coverage delivers basic protection against bodily injury and also building damage triggered by the covered by insurance driver in an at-fault accident. Alternatively, comprehensive coverage supplies a broader stable of protection, consisting of protection for damage resulted in by aspects including fraud, hooliganism, or even organic calamities. It is essential for vehicle drivers to very carefully review their insurance policy and also understand the coverage offered by their insurer to ensure they are actually sufficiently guarded while driving in the bustling city of Las Vegas.

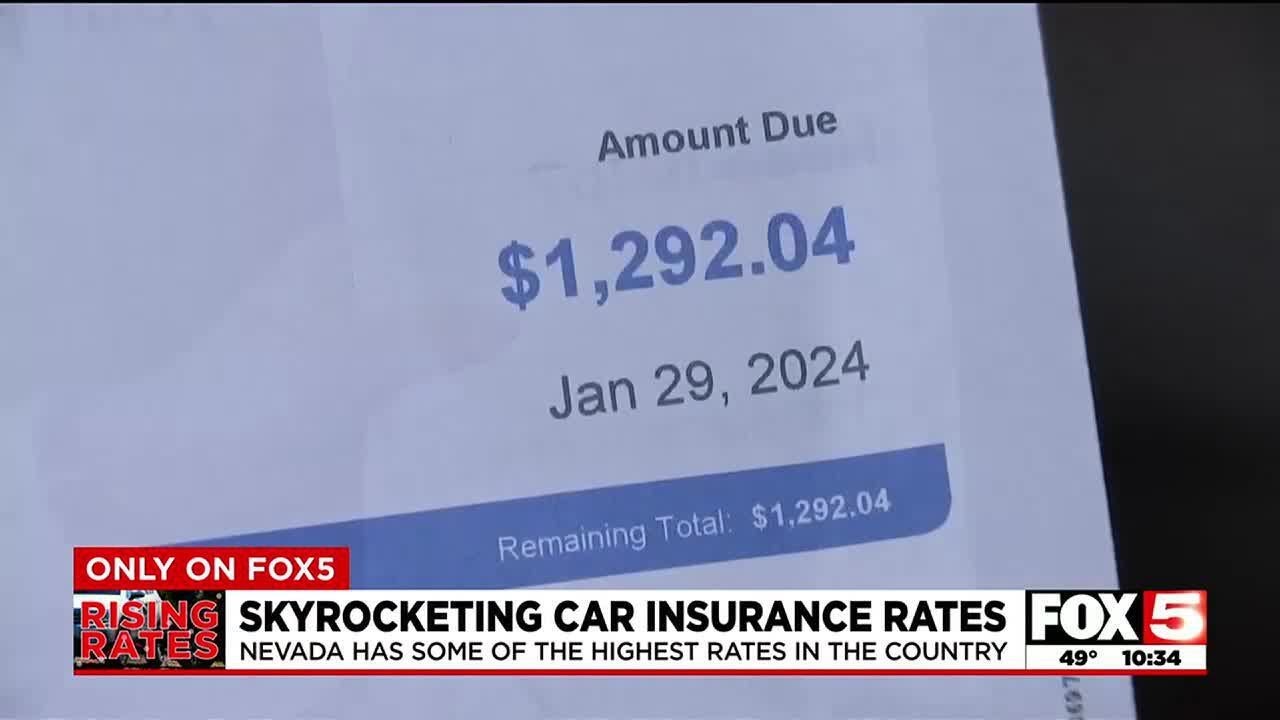

Just how much performs car insurance cost in Las Vegas?

Car insurance prices in Las Vegas may differ relying on several elements. Auto insurance companies in the place take right into profile a series of variables when identifying costs for drivers. These can include driving record, coverage limits, bodily injury liability, property damage liability coverage, and also coverage options like detailed and crash insurance coverage. The average cost of car insurance in Las Vegas is greater than the national average, which could be credited to the distinct traffic conditions as well as driving routines in the city.

For teen drivers, the expense of car insurance may be substantially much higher because of their shortage of experience when driving. In Las Vegas, insurance rates for teen vehicle drivers are actually affected by aspects like the type of vehicle they drive, their driving record, and also the quantity of coverage on their auto policy. It is actually encouraged for moms and dads to explore various options to find affordable car insurance for their teen car drivers, like packing insurance plans or installing a telematics device to likely lower insurance rates. Providers like Geico use quotes that take note of a variety of factors to offer customized protection for motorists in Las Vegas.

Las Vegas car insurance discounts

In Las Vegas, auto insurance discounts can easily aid motorists spare amount of money on their insurance premiums. Many insurance provider deliver markdowns for numerous factors including possessing a really good driving record, being a student along with really good levels, or packing a number of insurance plan with each other. Through making the most of these rebates, vehicle drivers may reduce their auto insurance rates and locate cheap car insurance that accommodates their finances.

Another technique to potentially lower your auto insurance rate in Las Vegas is by preserving continuous insurance coverage. Insurance providers often offer savings to motorists that have a past history of dependable auto insurance coverage with no lapses. Through presenting proof of insurance and demonstrating liable behavior responsible for the steering wheel, drivers can easily train for lower insurance fees. Furthermore, some insurance provider may give unique savings for particular teams, including female motorists or even students, so it is actually worth examining with your insurance agent to observe if you apply for any kind of added savings on your monthly premium.

Average car insurance in Las Vegas by rating factor

One essential factor that affects the common car insurance rates in Las Vegas is the type of vehicle being guaranteed. Insurance providers consider the make, version, and also grow older of the vehicle when finding out prices. For example, guaranteeing a high-end cars are going to typically possess greater costs compared to a common car. The level of insurance coverage selected also affects the expense, with comprehensive coverage being more costly than general liability coverage.

One more crucial aspect that determines common car insurance rates in Las Vegas is the driving past of the insurance holder. Responsible motorists with well-maintained driving reports are actually usually eligible for safe driver discounts, which may cause lower premiums. On the contrary, individuals with a record of accidents or traffic transgressions might deal with much higher rates as a result of being recognized as higher threat by insurance business. Moreover, grow older can likewise participate in a significant duty in insurance rates, as 20-year-old vehicle drivers are actually normally thought about riskier to insure contrasted to a 35-year-old motorist. Insurance providers take into consideration various elements such as the rates of accidents including youthful drivers, observance with teen driving laws, and total driving routines when identifying costs.

Why is actually car insurance in Las Vegas thus pricey?

Car insurance in Las Vegas is notably costly due to numerous adding factors. One notable aspect is the eligibility requirements specified through auto insurers, which can easily affect the price of protection. In Nevada, minimum coverage requirements contrast around metropolitan areas like Boulder City, Carson City, and Las Vegas, with major cities often imposing greater standards. Furthermore, elements like financial strength ratings and rating elements may determine fees. It is actually crucial for motorists to think about car insurance variables such as bodily injury liability, uninsured motorist coverage, and underinsured motorist coverage when evaluating coverage levels, as these elements can dramatically affect the overall expense of insurance.

Furthermore, the introduction of added attributes like anti-theft units and looking for rebates, such as those for full-time pupils, can also determine the price of insurance in Las Vegas Implementing digital policy management resources as well as discovering choices for student price cuts can easily deliver financial protection while potentially reducing fees. Auto insurers in Las Vegas often base sample rates on numerous aspects, consisting of coverage levels and also private scenarios. Through watching about fulfilling minimal criteria as well as looking into available discount rates, motorists in Las Vegas can easily seek methods to create car insurance more economical without risking essential insurance coverage.

Bundling insurance in Las Vegas

When it concerns bundling insurance coverage in Las Vegas, policyholders can uncover several discount opportunities by integrating a number of insurance items under one supplier. This method certainly not merely streamlines the insurance process however additionally often leads to cost discounts. In Las Vegas, insurer typically supply discount rates for bundling automotive and home insurance, allowing people to gain from affordable rates while guaranteeing comprehensive coverage throughout numerous parts of their lifestyle.

Besides reduced yearly premiums, packing insurance coverage in Las Vegas can additionally streamline managerial duties through merging all plans into one quickly accessible electronic format. Whether it is actually taking care of a small fender bender or even reviewing coverage options, possessing all insurance details in one place could be hassle-free as well as efficient. In addition, packing can easily help stop a lapse in coverage, ensuring individuals possess constant protection around various insurance types including bodily injury coverage, medical payments coverage, as well as additional coverages at the lowest rate achievable.

What are actually the liability insurance criteria in Las Vegas?

In Las Vegas, vehicle drivers are demanded to have liability insurance coverage of at the very least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for home damage.

The amount of performs car insurance cost in Las Vegas?

The cost of car insurance in Las Vegas can differ relying on elements like your driving record, grow older, the sort of automobile you steer, and the insurance company you pick. On standard, motorists in Las Vegas pay around $1,400 annually for car insurance.

What are actually some auto insurance discounts on call in Las Vegas?

Some popular auto insurance discounts accessible in Las Vegas feature multi-policy rebates for packing numerous insurance policies, safe vehicle driver discounts, and also savings for having actually anti-theft gadgets set up in your cars and truck.

What is the normal car insurance in Las Vegas through rating factor?

The common car insurance in Las Vegas can easily vary through rating factor, however elements like age, driving record, as well as sort of automobile driven can easily all impact the price of insurance.

Why is actually car insurance in Las Vegas so costly?

Car insurance in Las Vegas may be much more pricey than in various other places as a result of factors including a higher cost of collisions, burglary, as well as hooliganism in the city, and also the cost of living and also insurance policies in Nevada.

Just how can bundling insurance coverage in Las Vegas assist in saving amount of money?

Packing insurance in Las Vegas, such as incorporating your automobile and also home insurance along with the very same supplier, can easily frequently result in discount rates coming from the insurance company, ultimately assisting you conserve amount of money on your total insurance prices.